Comparing and Positioning Sage X3 ERP

Sage X3 ERP comes out strong when compared to other industry ERP system.

Background

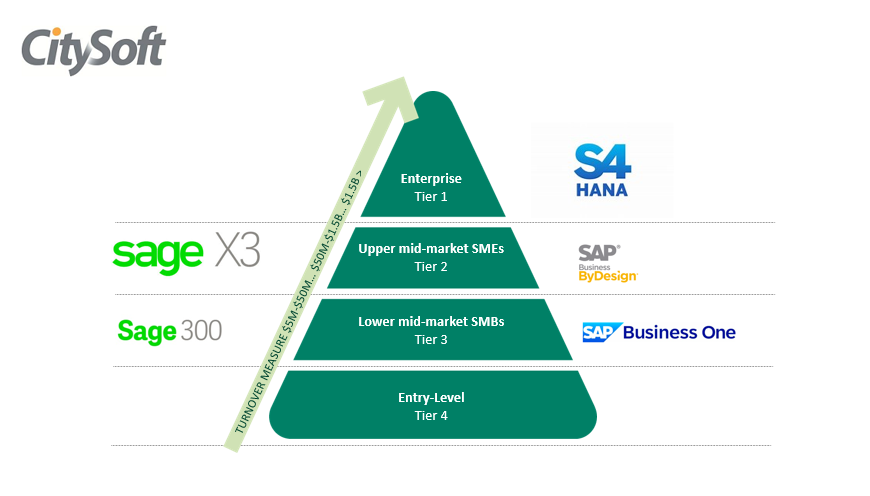

There are differing opinions amongst industry experts and vendors alike on how best to segment the Advanced Business Software (ERP) Market place. Business size measured by employees and turnover are the most used criteria.

For buyers, the most important understanding is that ERP software is designed with a target business size in mind. Developers use employee numbers and revenue to position, price and market their products. Buyers still need to be on guard however as some vendors try to expand their products reach into segments where they simply don’t fit. Further still, some vendors have tried to redefine segments which has generally led to unnecessary buyer confusion.

Whilst there are always exceptions to the rule size of business generally determines which segment of the ERP software marketplace a buyer should concentrate on.

The generally accepted ERP business software segments are entry-level (Tier 4) basic accounting systems for start-ups and small businesses with basic needs. They are typically supplied as online services and don’t require any accounting expertise to use them. The typical business profile of users of this software has turnover at under $5M p.a. AUD.

Tier 3 businesses are defined as those businesses with turnover between $5M p.a. AUD to around $50 M turnover p.a. AUD.

Tier 2, also referred to as the small to medium sized enterprise segment (SME segment) focuses on enterprises with turnover somewhere between $50 M p.a. AUD through to $1.5 B AUD p.a. SMEs generally have multi-site, multi company characteristics that sets them apart from SMBs in the tier 3 space. They may even operate in multiple countries. User numbers are generally greater than tier 3 businesses ranging from 30 through to multiple thousands of users. SAP and Oracle own the lion’s share of ERP software clients in the Tier-1 space – the globe’s largest enterprises.

Figure 1: An accepted industry definition of ERP segments 1-4

Sage X3 ERP vs S/4HANA & Oracle

Sage X3, SAP S/4HANA, & Oracle Cloud ERP are enterprise-grade ERPs designed to handle multi-company, multi-currency, and multi-country operations with deep manufacturing, distribution, and compliance capabilities.

S/4HANA, & Oracle Cloud ERP are tier 1 ERPs. Sage X3 is best described as a less expensive alternative to S/4HANA or Oracle for SMEs, with a case for positioning Sage X3 ERP as both a tier 2 SME option and a tier 1.5 ERP segment entrant.

From a positioning perspective Sage X3 ERP is leaner, faster, and more cost-effective than SAP or Oracle to implement and operate. Sage X3 ERP delivers most of the functionality of SAP/Oracle at a fraction of the cost and in shorter project timeframes. Sage X3 ERP exists as an excellent option for enterprises at the bottom of the tier 1 segment.

Sage X3 suits both small and mid-to-large global enterprises who have complex supply chains, multinational compliance demands, or advanced manufacturing needs. Sage X3 offers a smarter, more affordable route to enterprise ERP than these other tier 1 ERPs.

The typical ERP project timelines for Sage X3 ERP is between 9–18 months (enterprise ERP at speed) whereas SAP / Oracle is 18–36+ months (large-scale global rollouts).

SAP and Oracle deliver the broadest set of functionality but at 2–3× the cost and time of Sage X3 ERP. The investment differential makes Sage X3 ERP an attractive proposition for enterprises sitting in tier 2.

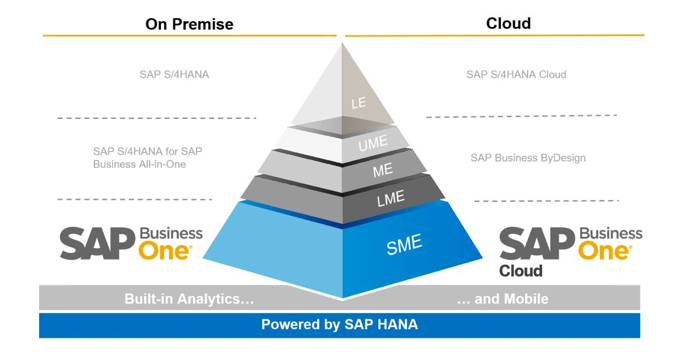

Figure 2: SAP’s industry segmentation & ERP product positioning

Sage X3 ERP vs SAP Business One & Sage 300

SAP Business One and Sage 300 are excellent ERPs for SMBs. They are not tier 2 ERPs.

If compared to tier 3 ERPs, Sage X3 ERP will appear expensive however significantly cheaper SMBs lack the enterprise-class scope of Sage X3 ERP. For a business that genuinely needs Sage X3 ERP, these tier 3 systems quickly hit scaling and compliance limits making the licensing and one-off savings on project services evaporate quite rapidly.

There are a small number of reasons why a buyer may shortlist both tier 3 and tier 2 ERP systems for consideration.

Often a decision to compare both tier 3 and tier 2 ERP systems is tied to the buyer’s growth expectations, and in other instances the business may not fit the profile of a tier 2 business, however they may have a business demand(s) for functionality that is only available in a tier 2 ERP system. These businesses exist in the “fuzzy” border zone between segments.

The availability of some excellent industry specific products for SAP Business One and Sage 300 go a long way to broadening their appeal to larger businesses (SMEs) however in most instances the functional scope of the products still fails to match those offered by Sage X3 ERP and other tier 2 ERPs. Additionally, the investment differential narrows quite significantly when adding extension products or modules to the tier 3 ERPs. Under these conditions Sage X3 ERP generally delivers buyers with a superior solution translating into better investment value.

Buyers need to remain vigilant as there is no shortage of SMB and even tier 4 products promoting themselves as SME ERP products but a cursory read of their claims should help the astute buyer correctly place them in the right ERP bucket.

Focusing for one moment on Sage 300 and SAP Business One, the one database design for each company in SAP Business One and Sage 300 limits the attractiveness of these products to SMEs who genuinely need multi company, inter-company and consolidation capabilities and who regularly trade amongst related entities. The scope of functionality of add on multi and inter-company modules for SAP Business One and Sage 300 will work for some SMEs but by and large the functionality is an after thought which leads to a shallower product footprint and limited flexibility to deal with SME complexities.

In short, tier 3 ERP products are generally best suited to buyers who operate a single-entity in a single-country or who operate multiple unrelated companies where any intercompany trade or intercompany transactions are infrequent, if any at all. If there is a need for consolidation of entities a tier 3 business is generally satisfied with a consolidated financial reports solution.

The tier 3 ERPs are also suited to those companies who operate basic accounting and operations and who have basic supply chain processes. Coming back to Sage 300 and SAP Business One again, both these ERPs rely on 3rd party advanced warehousing systems to manage modern mobile and paperless warehousing.

Sage X3 ERP by comparison offers enterprise-grade capabilities:

- Advanced manufacturing & production planning

- Advanced Warehouse & supply chain management

- Global financial consolidation (multi-currency, multi-legislation)

- Workflow automation & compliance

- Broad API-first integration capabilities

- True Web native ERP

Sage X3 ERP offers enterprise-grade capabilities designed to handle multi-company, multi-currency, and multi-country operations with deep manufacturing, distribution, and compliance capabilities. It was designed to do this.

Save for add on modules neither core Sage 300 & SAP Business One were developed for manufacturers.

Summary of Sage Company:

- Origin: UK, listed on London Stock Exchange

- Scale: ~12,000 employees, millions of customers globally

- Focus: Mid-to-large enterprises across multiple industries

- Global reach: Offices in 20+ countries, solutions in 150+ countries

- Support ecosystem: Strong global partner network, large R&D investment (~£400m annually)

Sage X3 vs Other SMEs

Buyers of ERP software for MSEs often consider Sage X3 ERP, Pronto, NetSuite and Microsoft Dynamics 365 (BC & F&O). On occasions we meet buyers who are considering both tier 4 accounting systems, some of whom incorrectly label themselves as ERP systems for SMEs, and tier 2 ERP systems. The wrongly positioned ERPs typically focus on accounting & payroll and only offer light inventory management.

Pronto sits in the tier 2 space, with stronger functionality than tier 3 ERPs, especially in inventory and distribution, but it is still primarily focused on ANZ markets and is not truly global in scope. It may suit mid-sized ANZ-based companies that need stronger inventory or ERP but with a local/regional focus only.

Summary of Pronto:

- Origin: Australia

- Scale: ~400 employees

- Focus: Mid-market ERP with strength in distribution and retail

- Global reach: Very limited, mainly ANZ

- Support ecosystem: Vendor-delivered project services and support

Pronto doesn’t appear to have the resources and funds to keep up with the global leaders. Sage’s R&D investment is ~£400M annually.

Netsuite offers a direct and partner eco-system which can be quite interesting for buyers, at times. Netsuite is exclusively vendor SaaS delivered as a multi-tenanted solution however like many if not all SME SaaS vendors for various reasons, a multi-tenanted SaaS doesn’t necessarily work for mid-market businesses.

Sage X3 ERP is available under a public or private cloud arrangement with Sage partners such as CitySoft offering full Cloud hosted services. In certain regions Sage X3 ERP is made available as a vendor SaaS.

From a functional perspective the experts agree that Sage X3 ERP is a superior system than NetSuite for process manufacturers.

Anecdotally, Netsuite aggressively price their year one fees, to win business, lock in businesses to their service & rapidly recoup any year one discounts in subsequent years. From our observations they tend to focus heavily on being less expensive than their competitors rather than highlighting their investment value. Offshore online training and consulting services and messaging that Netsuite is easier and less expensive to implement than its competitors seem to be at odds with the products mid-market positioning, sophistication and capabilities.

On occasions, CitySoft competes for new tier 2 business, leading with Sage X3 ERP, and comes up against Microsoft Dynamics 365 (BC & F&O). The investment profiles of these two Microsoft ERP options (BC & F&O) are very different. BC is a tier 3 ERP and Microsoft position F&O as a tier 1 ERP. Our observations are that there are plenty of companies selling Microsoft ERP systems who aren’t sufficiently qualified to do so. Occasionally we compete with Microsoft or their master distributors who are rolled in to present on behalf of their partners.

Contact Us

Take the next step & get in touch with a solution architect today